International Masaryk Conference for Ph.D, 2023

VLIV ASYMETRIE INFORMACÍ NA ROZHODOVÁNÍ AKTÉRŮ V PROSTŘEDÍ POJISTNÉHO TRHU

THE INFLUENCE OF INFORMATION ASYMMETRY ON THE DECISION-MAKING OF ACTORS IN THE ENVIRONMENT OF THE INSURANCE MARKET

Daniel Markvart, Jaromír Tichý

Abstrakt:

V 21. století se setkáváme s termínem "emerging risks" - nově vznikající rizika v nových kontextech. Asymetrie informací má zásadní vliv na rozhodování a aktéři trhu se stále více spoléhají na stát jako "pojistitele poslední instance". Regulace trhu může být přiměřená, ale neměla by bránit konkurenci a inovacím. Zásahy do tržních procesů často vedou k morálnímu hazardu a k podcenění rizik. Vnímání rizika zahrnuje i psychologický aspekt, jak ukazují teorie o averzi k riziku. V současnosti dochází k podcenění vlastní odpovědnosti vůči procesu hodnocení a řízení rizika a k hrozbě morálního hazardu pod vlivem regulátorů ovlivňujících stabilitu a transparentnost sektoru pojišťovnictví. Cílem příspěvku je určit úroveň vlivu asymetrie informací na rozhodování aktérů v procesu hodnocení a řízení rizika v činnosti podniku, s možností v budoucnu riziko eliminovat. Dotazníkovým šetřením je ověřeno, zda dotazovaní z podnikatelského prostředí vyhledávají jistotu.

Abstract:

In the 21st century, we encounter the term "emerging risks" in new contexts. Information asymmetry has a major influence on decision-making, and market actors increasingly rely on the state as an "insurer of last resort". Market regulation can be reasonable, but should not hinder competition and innovation. Interventions in market processes often lead to moral hazard and underestimation of risks. Risk perception also includes a psychological aspect, as shown by risk aversion theories. Currently, there is an underestimation of one's own responsibility towards the risk assessment and management process and the threat of moral hazard under the influence of regulators affecting the stability and transparency of the insurance sector. The goal of the contribution is to determine the level of influence of information asymmetry on the decision-making of actors in the process of risk assessment and management in the company's activities, with the possibility of eliminating the risk in the future. The questionnaire survey verifies whether the interviewees from the business environment are looking for certainty.

Keywords: asymmetry of information, insurance market, insurance company, reinsurance company, broker, moral hazard, risk management

1 INTRODUCTION

Risks have evolved not only with the changing economy, innovations and division of labour, but also in the context of social changes in industrial society. (Sirůček, 2007) The history of economic thought will help us better understand some of the current processes in society. In this context, one can rely on the works of Doležalová, 2022, Holman, 2017. The questions of whether it is possible to predict, plan and prepare for risk have been solved by companies, and their solution is required even in the current post -industrial era. (Haywood, Catchpole, Hall, Barratt, 1998) Since the beginning of the 21st century, the term "emerging risks", which can be translated as "newly emerging risks", has become increasingly relevant. Emerging risks are "new risks or known risks that become apparent under new or unknown conditions". (Hall, 2021) Under the influence of the current mainstream economy, the state is increasingly involved in market processes and, above all, there is an underestimation of one's own responsibility. (Eisen, 2012) Under the influence of regulators, who indirectly influence risk assessment and management, companies still rely on the help of the state as "insurers of last resort". None of them, especially the state planner, has perfect information. They are often asymmetrical. The analysis of information asymmetry brings a new perspective on the interactions of actors who are participants in the insurance market. (Daňhel, 2002) Also due to the institutional arrangement for the management of common resources and public goods at the EU level, moral hazard often occurs, when under the influence of this "certainty" all market actors take risks, but mostly clients who either stop perceiving certain risks, or they underestimate them. Thus, there is an unwanted transfer of risk outside of market processes. However, the greater degree of responsibility of all actors towards goods in a free market environment logically leads to much greater prudence. (Ostrom, Williamson, 2007)

The contribution tries to propose some new solutions and new processes among the actors at the risk management level of the company: Insurer - Broker - Client (I-B-C), which can significantly help in the evaluation and elimination of risk under acceptable market conditions, especially in the area of "not yet managed" risks and modern risks arising from the dynamic market environment, changing legal norms and social changes.

2 METHODS OF PROCESSING THE ISSUE

The content of the solution is an analysis of the historical development of economic thinking in relation to the types of risks and their influence on economic activities. The method of risk assessment is characterized (how the risk was perceived, how the risk was prevented or prepared for, including the risk management tools that were available). The position, the role of the insurance company and the insurance broker and the asymmetry of information are analysed. The questions of the questionnaire survey are focused on the degree of impact, risk aversion, risk transfer, creation and re-evaluation of the risk catalogue, the role of the insurance broker, criteria for choosing an insurance company, the influence of marketing tools on decision-making, trust in the intervention of the state or states in the public economic sphere. The questionnaire survey verifies whether political decisions at the level of the state or "superstate" can change approaches to risk even of entire segments of the economy.

When using a questionnaire survey, a specific group of managers at the company level from all fields of business activity is interviewed. Managers are selected at the level of statutory bodies or directors or the owners themselves. Enterprises are categorized according to company turnover, which is in the range of CZK 100 million - CZK 5 billion. The number of respondents is 88. The tool is a questionnaire, in the form of an interview - discussion. The questions are supplemented with statistical data related to the given issue, and the knowledge is supplemented with the experiences and opinions of risk managers and workers from insurance companies. The resulting data are compared.

Basic questions of the questionnaire survey:

1. Could the risk (past, already known) be predicted, was it possible to theoretically prepare for its future elimination? (Progress, consequences and other possible future risks arising from the given situation. Possible impacts and sanctions. Searching for a way to answer other questions).

2. How do you perceive and evaluate current risks, how do you relate to them and how can you prevent them?

3. How do you perceive the risks arising from the expected future development of society and the economy? How do you perceive the current regulations?

4. According to what criteria do you choose an insurance company? Is the role of a broker important to you?

The next step is to compare the results of the questionnaire survey with the Allianz Barometer (AB) risk barometer from 2022, together with the survey, it characterizes the development of client preferences over time and geographical space. Some questions directly related to risk are compared with publicly available statistics and research. The survey results are compared with the published statistical results of the reputable agency AXCO (2022).

3 RISK AND ITS PERCEPTION

Random events can cause loss of lives, health and material values. (Daňhel, 2006) It is surprising that risks are often underestimated even by clients at the company level. This can in many cases be due to the ever more prominent subsidization of the economy, which was typical in the Marxist-conceived economy. At the same time, one of the goals and an important element of the economic transformation after the political changes in Central Europe was precisely desubsidization. (Klaus, 2021)The failures of banks, investment funds and pension funds have led regulators to interventions, which even advocates of Smith's invisible hand of the market can understand. (Fagan, 2002) Due to the asymmetry of information, when the disadvantageous position is on the side of the consumer, his "Keynesian" protection occurs. Arbitrary clearing of the market is not desirable in many cases, especially in the financial sector, because usually of the parties – the consumer – did not commit any market failure. Daňhel and Ducháčková (2012) have justified critical comments on Stiglitz's interpretation of information asymmetry in insurance markets. Adequate regulation is certainly in order, but it must not ultimately lead to the elimination of competition. Unreasonable interventions not only defy common sense, but limit innovative processes, prices and balance. (Onder, 2006, 2010) The current issue of "Pojišťovna VZP" in the field of insurance for foreigners, which is in conflict with the Solvency II Directive and the SFEU can be an example.

A person makes decisions based on instinct, the decision is based on an inner feeling, he is usually not able to explain why he made a decision in a given way. The issue of individual decision-making is connected, among other things, to the issue of risk aversion. The terms "Risk aversion" or "Loss aversion" are mentioned in the literature, i.e. resistance to risk or loss, which is a crucial term when we talk about risk, or on decision making under uncertainty. (Tversky and Kahneman, 1979)

Theoretical findings from the perception of risk from the psychology point of view play an irreplaceable role in the entire process and are an integral part of it. (Kahneman, 2012) Hard-to-estimate risk - danger - are risks that are difficult to imagine, "black swans". This theory explains important unexpected events that have a significant impact on society. These events deviate from what is normal and are therefore difficult to predict. (Taleb, 2011) The client has a tendency to insure known risks of a smaller scale and not to insure risks that are difficult to predict and of a larger scale. In order to work with risk, it is necessary to categorize it. (Bannister, 1981) European and Asian populations are afraid of risk, even the resulting failures are considered socially unacceptable. This is not the case e.g. in the US, where risk and failure are considered a part of life leading to further challenges to keep improving. Such an environment is healthier and corresponds to the modern economy and its capture of risk within the so-called behavioral economy. However, this primarily requires the personal responsibility of each of us. (Kahneman, 2012)

4 HISTORICAL-ECONOMIC DEVELOPMENT OF PERCEPTION AND MANAGEMENT OF RISK

Society is usually organized with the help of institutions. This is how institutions are created, both extractive and inclusive. Institutions are supposed to influence the development of the financial sector and therefore also the perception of risk. (Acemoglu, 2015) Society consists of people and people act. Human action (Mises, 2018) fundamentally affects the aforementioned interactions of everyone. There must be trust in each society. This also applies to economic activity. It is a complicated model – a process that cannot be planned. (Hayek, 1995) Due to the high level of risk, stemming primarily from unpredictability and possible social impacts, an adequate level of regulation is also necessary. (Cipra, 2015) A high-quality legal environment is also the basis. This often changes as a reaction to fluctuations in the market environment and, together with regulations, often ceases to be an effective tool. Excessive regulation greatly violates these basic market principles. Subsidization of insurance, inclinations/tendencies to oligoplolization, price regulation can disrupt balance and social relations in society. People are able to come to an agreement and find an effective solution without significant state intervention. These are classical phenomena, but they do not fit into the dichotomous world of "economic and social systems", i.e. the market and/versus the state. (Ostrom, 2007)

In major disasters, it is obvious that a chain of other events often occurs as a result of one event. These can have far more serious consequences. The relationships between risk, its elimination, economic thinking, economic policy, political organization and ideologies in the 20th and 21st centuries are demonstrated. However, the direct influence of economic theories, including economic schools, on insurance and risk, with the exception of Marxist ideology, and partly also the ideology of Nazi Germany, cannot be fully proven. However, it can be clearly demonstrated that the economic policy of states had a direct influence on the perception of risk and insurance. Historically, therefore, insurance has often been fundamentally influenced by the economic policy of states. By transferring all possible risks, including social ones, the company tried to grasp the danger. Insurance becomes part of public finances, work with risk, and the protection of property and lives part of the smooth running of society. And that's how mandatory and statutory insurance were created. A demanding society will lead to ever greater demands on the insurance industry. However, it is not possible to prepare for all risks because we do not know all of them. The external world is unpredictable and there is no ideal mathematical solution, as Daňhel (2006) explains. The political tendency is to demand commercial insurance of such risks and their consequences, which were so far uninsurable, in an attempt to compensate for unsystematic or erroneous political decisions disturbing the market balance or the price mechanism.

The catalogue of risks did not correspond to the catalogue of today's risks, according to the Allianz Risk Barometer (2022) and our own research (questionnaire survey). Historically, people considered the fundamental risk of natural disasters, the risk of a pandemic and the resulting risks of disruption of economic activity, and later liability risks. The catalogue of risks changes with the development of the society. However, global risks do not correspond to local risks. The comparison shows that one type of risk can be perceived differently in Europe, America, Oceania, Africa and the Middle East. In industrially oriented countries, the order of the catalogue of risks will be different than in agriculturally oriented countries, the political structure, climatic conditions, experience from realized risks, etc. play a significant role. The catalogue of risks also changes over time in different areas, mostly for similar reasons. The development of the catalogue of risks can also be influenced by the extent to which they are communicated by the media.

5 RESULTS OF A QUESTIONNAIRE SURVEY

Currently, there is a change in the perception of risk and the position of the decision maker's own responsibility. The insurance industry is currently heavily influenced by regulations and the harmonization process within the EU. It can be argued that it is the current regulations that bring stability to the entire financial sector. However, such an objection will succeed especially with a part of society that prefers a higher or high level of state intervention in the free market and tries to delegate the responsibility of the individual to a higher authority. However, history shows that such delegation "to someone" can also have fatal consequences.The findings show how preferences have changed over the past ten years (2013-2022), with reference to the Allianz Risk Barometer, which shows the change in preferences over time.

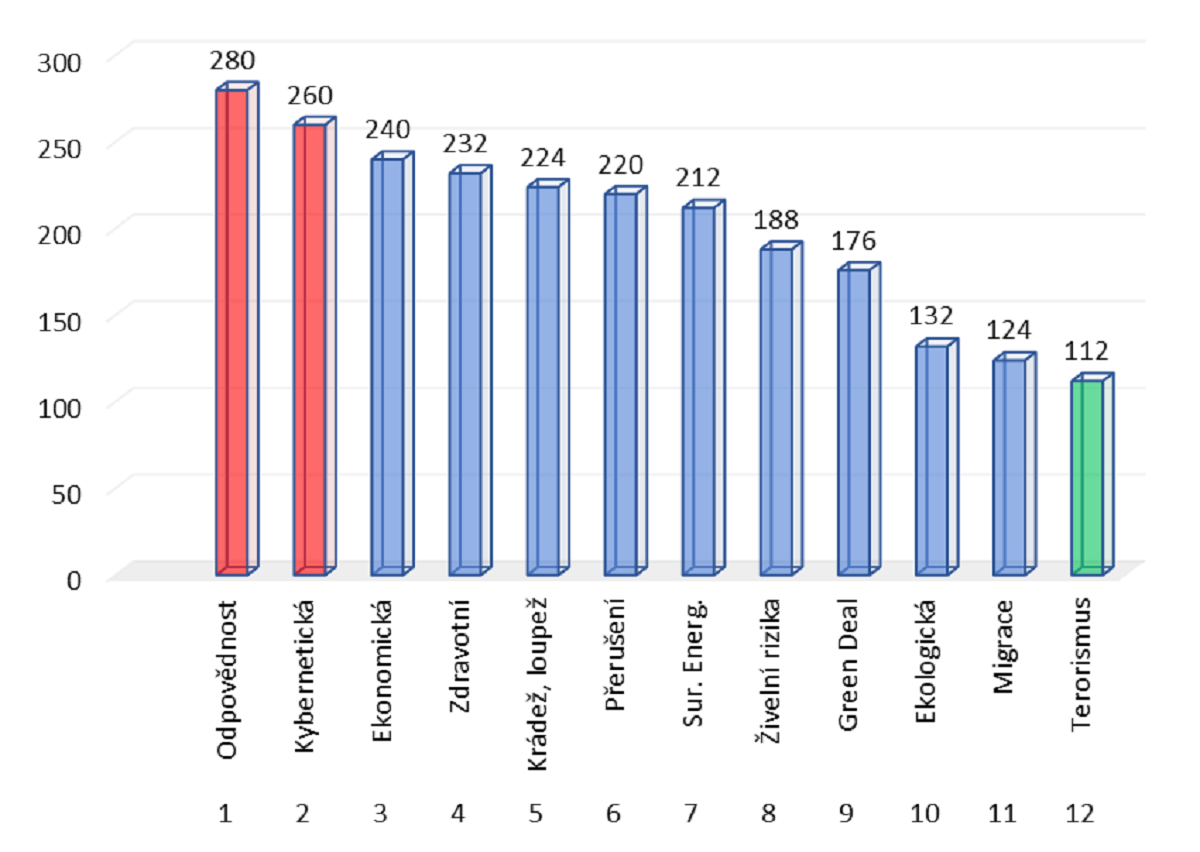

It follows from the questionnaire survey that, similar to the results of the Allianz Barometer survey (2022), clients consider the following to be the most feared risks:

1. risk arising from liability,

2. cyber risks,

3. economic risks,

4. health risks.

From the given answers it can be concluded:

- Even during the covid-19 pandemic, health risks do not represent the biggest danger for the interviewees.

- Risks which in history were perceived as fundamental risks – flood, inundation, storm, fire, explosion, etc., are currently considered by the interviewees to be partially or completely managed and insurable.

- The liability risk is considered to be a very fundamental and probably unmanaged risk.

- In the order (barometer) of risks, respondents are more afraid of modern risks, especially cyber risks.

- Respondents perceive other modern risks (economic, disruption of raw material supplies, migration, ecological risks, Green Deal, migration, terrorism) significantly less.

- 64 out of 88 respondents incorporate historical experience from past known events into risk considerations.

- A significant part of clients is risk averse.

- Government interventions in economic activity are considered beneficial by a smaller part of the respondents.

- The vast majority of respondents do not believe in the ability of governments to maintain the social-pension insurance model.

- The vast majority of respondents state that their company does not have a risk manager.

The issue can be summarized as follows:

- All actors work with asymmetric information, which affects the entire process.

- The insurance company primarily evaluates the quantitative aspect.

- The client can assess the risk both quantitatively and qualitatively.

- The criteria for choosing an insurer are individual.

- The entire process is also influenced by distribution and marketing tools (including media).

- All actors are affected by regulation and state intervention.

- Clients are looking for certainty.

In the past, even in the current concept of economic thinking, there were state regulations and interventions in the insurance process. This is still a relevant topic today, even with the applications of Basel 3 (increased regulation of banks) and Solvency II. Process participants often have less space and options to respond to market needs. At present, it is necessary to proceed from Act No. 277/2009 Coll., on the insurance industry, as amended, which implemented Directive 2009/138/EC Solvency II. On the basis of this law, Decree No. 306/2016 Coll. was issued, which stipulates, for example, the calculation of the solvency capital requirement. Other factors influence the decision of whether to insure or not. The position of financial institutions (insurance companies) in the market is also influenced by marketing strategies and the media. These, in their complexity, positively or negatively motivate the client to use this instrument. The level of perception and management of emerging - modern risks presents new challenges and a fundamental change in the approach to them. (Silent, Markvart, 2022)

Fig. 1: Survey results – ranking of risks as perceived by respondents (total number of points)

Source: own creation.

States operate political constructs in the insurance sector to varying degrees, which are a manifestation of state interventionism and public policy. Insurance programs are supposed to be, as stated, a path to "certainties" in the welfare state, and the usual insurance mechanisms do not work for them.

Changes in the social and economic environment will certainly lead to a certain modification of risk behaviour on the part of the client, but also to the modification of the products of others. The demand for "security" is still growing, but in the current collectivist concept it is a demand for certainty. It is a question whether the demand for private insurance will grow in the future as one of the options for diversifying risks, or whether the state will be the first, but also the last instance, in the realization of any risk. However, the state does not and cannot assume all risks.

Governments do not take responsibility for economic risks either. We are currently witnessing a completely unprecedented situation where governments, especially in the Euro-Atlantic area, not only violate economic laws, but also violate physical laws. Clients are in an environment of inefficient financial thinking. Governments and current mainstream society camouflage the causes of problems such as the current rate of inflation and artificially created market imbalances. They simply do not accept problems. Governments manipulate public opinion with the support of the media, similar to what happened in the past. The majority opinion must be correct.

7 CONCLUSION

With regard to the investigated issue of risk perception for the position of the client at the SME level and based on the results of the questionnaire survey, the following measures can be recommended within the framework of the stability of the insurance sector. However, increasing tensions and uniformity are likely to mean that any new solutions may conflict with the interests of some subgroups.The insurance sector must:

- Respond to the development of science and technology (genetics, artificial intelligence, new technologies).

- Respond to regulations and deregulations that have an international dimension (the essence of the activity must remain the same especially for the client).

- Incorporate significant demographic changes into their considerations, the associated change in the division of labour.

- Solve the issue of distribution so that it still provides a sophisticated service at lower costs.

- Take into account that the same risks offered globally can be diverse in different places.

- Diversify risks such as social insurance or health insurance, spread risks between the public and private sectors, respond to changes in medical technology and science and the related lengthening of human life.

- Motivate to increased prevention, to search for its optimal rate – the marginal efficiency value.

- Optimize the management of risks associated with information (at the level of all I-B-C actors). Information is an asset.

- Use the dynamic development of information technology, filter relevant determinants from the obtained data (risk classification, analysis of social insurance, etc.).

- At the level of risk management, from the information obtained, react in all phases to the severity and frequency of catastrophic risks (with regard to the upward phase of the temperature cycle, population growth, increased urbanization and related economic activity).

- In this context, consider the use of today's alternative risk transfer tools (self-insurance, joint financial resources, insurance derivatives, captive insurance, etc.).

- Not to be subject to current ideologies that stem from the activities of non-profit organizations and part of the political representation, which are synchronized with a significant part of the mainstream (often uncritical) media - not to exclude a selected group from insurance (not to deviate from the essence itself).

- Exert maximum pressure on regulation and state intervention processes and eliminate the associated bureaucracy.

- Eliminate the financing of negative consequences from public sources - from taxpayers' money, support personal responsibility.

- Support educational activity in the field of social sciences at all levels, which is able to some extent eliminate the current perception of information asymmetries on the part of the client.

The following theses follow from the knowledge gained above:

- Commercial insurance company is a specialized financial institution, the goal of business is to make a profit (the same goal is for an insurance broker), it is not altruism.

- Information asymmetries exist, it depends on the degree of willingness to obtain information.

- High-quality information influence work with the risk at the SME level in the I-B-C process.

- The broker, if he represents the client, eliminates information asymmetry, unavailable or incomplete information can lead to moral hazard or adverse selection.

- Regulations and state interventions can affect information asymmetries, they often interfere with processes insensitively, leading to moral hazard, and those that lead to consumer protection often have counterproductive effects.

- Regulation of the insurance markets may result, ceteris paribus, in an increase in premiums.

- Regulation and state intervention tries to harmonize the activities of actors - One Size Fits All, harmonization can reduce the attractiveness of product innovations.

- Actors are able, under the assumption of high-quality legal frameworks and effective law enforcement, to resolve disputes by agreement or with the help of arbitrators, to resolve disputes more morally and efficiently without detailed regulation of details.

- Regulation and state intervention increase transaction costs for all parties.

- Market failure does not have a clear definition.

- Ideology, subsidization, paternalism affect the entire process of free trade, distort it and create imbalances.

- The catalogue of risks changes with scientific and technical progress, I-B-C respond to this process without regulation and state intervention, the set of risks cannot be completely exhausted by any tools.

- No entity, institution or government can guarantee certainties.

Within the framework of the historical-economic overview of the development of risk perception and management, including tools for its elimination, it was possible to partially confirm the claim that the approach to risk perception and management corresponded to the development of economic thinking. It was not possible to find clear connections between the risk, its elimination, the development of economic thinking and economic policy, especially before 1900, in the ten largest damages in terms of the number of victims and damages known to the general public (mainly from the 20th century). The largest damages were realized in different parts of the world with different political arrangements. The differences in the timeline are large, similar to the different development of society in individual parts of the world. I believe that in individual periods it was partially possible to verify and sufficiently explain the relationships between regulation and freedom, altruism, business and responsibility, spontaneous order and regulations, and above all between risk and certainty. These relationships arranged on a timeline with proven connections and degree of influence on risk - insurance - economic thinking are certainly an inspiration for further work.

The current instruments of protection against risk and the effects of regulations affecting the stability and transparency of the insurance sector were defined. An analysis of the position, role of the insurance company and insurance broker and asymmetry of information was carried out. Questionnaire survey questions focused on the degree of impact, risk aversion, risk transfer, creation and reevaluation of the risk catalogue (whether the interviewees are willing to perceive and quantify new risks), the role of the insurance broker, criteria for choosing an insurance company, the influence of marketing tools on decision-making, trust to interventions by the state or states in the public economic sphere were used. The questionnaire survey verifies whether the respondents are looking for certainty, i.e. they prefer a minimal probability of loss to a high probability of profit. So will they insure against all possible risks, even if the probability that they will be realized is minimal? It is verified that by the term all possible risks they do not mean "all imaginable risks". It was also verified whether political decisions at the level of the state or "superstate" can change the approaches to risk of entire segments of the economy.

Currently, there is an underestimation of one's own responsibility towards the process of risk assessment and management, and moral hazard also occurs under the influence of regulators, who influence the stability and transparency of the insurance sector with their decisions, both qualitatively and quantitatively. Insurance companies are conservative organizations, yet they have always responded very flexibly to the needs of society, often even in negative connotations, they have managed different political systems, different economic policies, different ideologies. The latter is, as follows from the previous text, a synthesis of various directions resulting from ideologically unanchored economic policies. It can be called, if we borrow M. Thatcher's expression, rather an economy of feelings. The insurance company does not seek truth or justice, it does not follow feelings, it should not be subject to ideologies. It should not exclude or favour any group for the ideological reasons of the current mainstream. Despite all the above-mentioned tasks, social or macroeconomic, they simply have to rely on mathematical models. It must be solvent if it wants to stay in the market, otherwise it will be gambling. There is no distributive social justice involved.

An important finding is that clients perceive the catalogue of risks differently from the global catalogue of risks repeatedly published by Allianz, and that they do not perceive asymmetry of information in the current world of fragmented knowledge as a fundamental problem. Clients confirm a certain degree of aversion to regulations and state interventions. In the future, the insurance sector, in its complexity, can make more use of modern technologies at all levels of the I-B-C process. I believe that without unnecessary government intervention, technology can be useful for everyone. New technologies such as neural networks, language models are constantly improving. They work with an ever-increasing amount of information and will be increasingly able to solve complex tasks. They already allow us, if we want to, to better eliminate asymmetries of information on both sides than was the case in the past. However, the basic prerequisite is investment and support for these technologies, as is the case, for example, in the USA and China. These investments for 2022 are several times higher than European investments. However, Europe is already preparing a number of regulatory measures. There is no doubt that they can facilitate a number of processes, for example, in risk management - the risk behaviour of the client, where they can better predict and eliminate future risks from a large amount of data. It will enable clients to better analyse and evaluate the insurance product.

References

1. ACEMOGLU, Daron a James A. ROBINSON, 2015. Proč státy selhávají: kořeny moci, prosperity a chudoby. Praha: Argo. Zip (Argo: Dokořán): Dokořán). ISBN 9788025713051.

2. AXCO, 2022. Non-Life Insurance Market Reports. [on-line databáze]. Report Generated: February © 2022 [cit. 2023-10-22]. Available from: https://www.axcoinfo.com/products/insurance-market-reports-non-life/

3. BANNISTER, J.E. a Paul BAWCUTT, 1981. Practical Risk Management. London: Hyperion Books. ISBN 0900886226.

4. CIPRA, Tomáš, 2015. Riziko ve financích a pojišťovnictví: Basel III a Solvency II. Vydání I. Praha: Ekopress. ISBN 978-80-87865-24-8.

5. DAŇHEL, Jaroslav a Eva DUCHÁČKOVÁ, 2012. Současné dilema ekonomie: vyšší etika, nebo širší regulace? Praha: Acta Oeconomica Pragensia. [2023-11-09]. 2012/02/01. DOI: 10.18267/j.aop.354

6. DAŇHEL, Jaroslav, 2006. Pojistná teorie. 2. vyd. [Praha]: Professional Publishing. ISBN 80-86946-00-2.

7. DAŇHEL, Jaroslav, 2002. Kapitoly z pojistné teorie. Praha: Oeconomica. ISBN 80-245-0306-9.

8. DOLEŽALOVÁ, Antonie, 2022. A history of Czech economic thought. London: Routledge, Taylor & Francis Group. Routledge history of economic thought. ISBN 978-1-138-91416-2.

9. FAGAN, B. M, 2005. Sedmdesát velkých záhad. Přel. M. Vosková a M. Trojánková. Slovart, Praha, 2005. 304 s. ISBN 80-7209-713-X.

10. HAYEK, Friedrich A. von, 1995. Osudná domýšlivost: omyly socialismu. Praha: Sociologické nakladatelství. Studie (Sociologické nakladatelství). ISBN 8085850052.

11. HAYWOOD, John, Brian CATCHPOLE, Simon HALL a Edward BARRATT, 1998. Historie světa: atlas světových dějin. Přeložil Věra KOTÁBOVÁ, přeložil Lubomír KOTAČKA, přeložil Kateřina PEKÁRKOVÁ. V Praze: Columbus. Encyklopedie. ISBN 80-85928-81-7.

12. HOLMAN, Robert, 2017. Dějiny ekonomického myšlení. 4. vydání. V Praze: C.H. Beck. Beckovy ekonomické učebnice. ISBN 9788074006418.

13. KAHNEMAN, Daniel, 2012. Myšlení: rychlé a pomalé. V Brně: Jan Melvil. Pod povrchem. ISBN 978-80-87270-42-4.

14. KAHNEMAN, Daniel and Amos, TVERSKY, 1979. Prospect Theory: An Analysis of Decision undel Risc. In: Econometrica, Vol. 47, No. 2. (Mar., 1979), pp. 263-292. Dostupné z: https://www.jstor.org/stable/1914185

15. KLAUS, Václav, 2021. Transformace v ČR: cesta ke svobodě a prosperitě. Praha: Oeconomica, nakladatelství VŠE. ISBN 9788024524184.

16. MARKVART, Daniel a Jaromír TICHÝ. Diagnostika vlivu asymetrie informací v prostředí pojistného trhu na rozhodování aktérů procesu vnímání, hodnocení a řízení podnikových rizik. In: Mezinárodní Masarykova konference pro doktorandy a mladé vědecké pracovníky 2021. © Copyright 2021 SCIEMCEE. MAGNANIMITAS. Hradec Králové, Czech Republic. roč. XII. 20.12.2021 - 22.12.2021. pp. xx-xx. ISBN 978-80-87952-33-7.

17. MARKVART Daniel a Jaromír TICHÝ. The influence of information asymmetry on the decision-making of actors in the environment of the insurance market. IN. MEZINÁRODNÍ MASARYKOVA KONFERENCE PRO DOKTORANDY A MLADÉ VĚDECKÉ PRACOVNÍKY 2023. © COPYRIGHT 2023 SCIEMCEE. MAGNANIMITAS. HRADEC KRÁLOVÉ, CZECH REPUBLIC. ROČ. XIV. 18. – 20. 12. 2023. pp. 348-358. 10 p. ISBN 978-80-87952-39-9. Dostupné z: https://www.vedeckekonference.cz/library/proceedings/mmk_2023.pdf

18. ONDER, Štěpán, 2010. Dopady finanční krize na řízení rizik pojišťoven. Český finanční a účetní časopis, 2010(3), 29-48. DOI: 10.18267/j.cfuc.74

19. ONDER, Štěpán, 2006. Architektura Solvency II. [online]. KPMG 2006 [2023-03-29]. Dostupné z: http://nb.vse.cz/kbp/TEXT/IIR%20SolvencyII.ppt

20. OSTROM, Elinor, 2007. Institutional rational choice: An assessment of the Institutional Analysis and Development Framework. In: Theories of the Policy Process, 2nd ed., Paul A. Sabatier (ed.). [online] Copyright © 2007 by Westview Press [2023-02-12], pp. 21-64. Dostupné z: http://edwardwimberley.com/courses/EnviroPol/theorypolprocess.pdf#page=27

21. PEARSON, Robin, 1997. Towards an Historical Model of Services Innovation: The Case of the Insurance Industry, 1700-1914. The Economic History Review, 50(2), Trebilcock.

22. RISK BAROMETR, 2022. Allianz [on-line]. [2023-11-20]. Available from: https://www.agcs.allianz.com/content/dam/onemarketing/agcs/agcs/reports/Allianz-Risk-Barometer-2022.pdf

23. SIRŮČEK, Pavel, 2007. Hospodářské dějiny a ekonomické teorie: (vývoj, současnost, výhledy). Slaný: Melandrium. ISBN 978-80-86175-53-9.

24. TALEB, Nassim, 2011. Černá labuť: následky vysoce nepravděpodobných událostí. Praha: Paseka. ISBN 978-80-7432-128-3.

25. TICHÝ, Jaromír a Daniel MARKVART, 2022. Diagnostics of the influence of information asymmetry on decision-making in the insurance market. In: 17h CER Comparative European Research Conference - International Scientific Conference for Ph.D. Sciemcee Publishing, London, April 25-27, 2022, vol. IX., issue I., pp. 75-81. ISBN 978-1-7399378-1-2.

26. VON MISES, Ludwig, 2018. Lidské jednání: pojednání o ekonomii. Druhé vydání. Přeložil Josef ŠÍMA. Praha: Liberální institut. ISBN 978-80-86389-61-5.

Kontaktní údaje

Daniel Markvart, DBA, MBA; Ing. Mgr. Jaromír Tichý, Ph.D., MBA

s i n n e I C a.s.

Turkova 780, Praha 4, 149 00, Česká republika

Vysoká škola finanční a správní, Fakulta ekonomických studií

Estonská 500, Praha 10, 101 00 Česká republika

email: Tato e-mailová adresa je chráněna před spamboty. Pro její zobrazení musíte mít povolen Javascript., Tato e-mailová adresa je chráněna před spamboty. Pro její zobrazení musíte mít povolen Javascript.

ZPĚT